EB-5 Investment Financing: A Comprehensive Overview

The EB-5 visa program offers a path to U.S. permanent residency through investment. To qualify for a green card, an investor must make an $800,000 investment in a targeted employment area (rural or high unemployment), or $1,050,000 elsewhere, while creating at least 10 new full-time jobs for U.S. workers. This program provides an excellent opportunity for individuals, students, and families seeking to live and work in the U.S. The EB-5 visa program is also popular amongst individuals residing in the United States on non-immigrant work visas such as H-1B, H4, L1A, L2 and E2; and international students on F-1 visas or optional practical training (OPT). If you're interested in learning more, please refer to our article and video library:

- EB-5 Visa: Basic Information and EB-5 Visa Requirements

- How the EB-5 Process Works and Timelines on Obtaining a Green Card

An EB-5 investor must provide evidence that the funds used for the investment were lawfully obtained, by documenting the source of funds. Acceptable sources of EB-5 investment may include personal savings, sale of property, investment portfolio, self-directed individual retirement accounts or SDIRA, a gift, or a loan, among others.

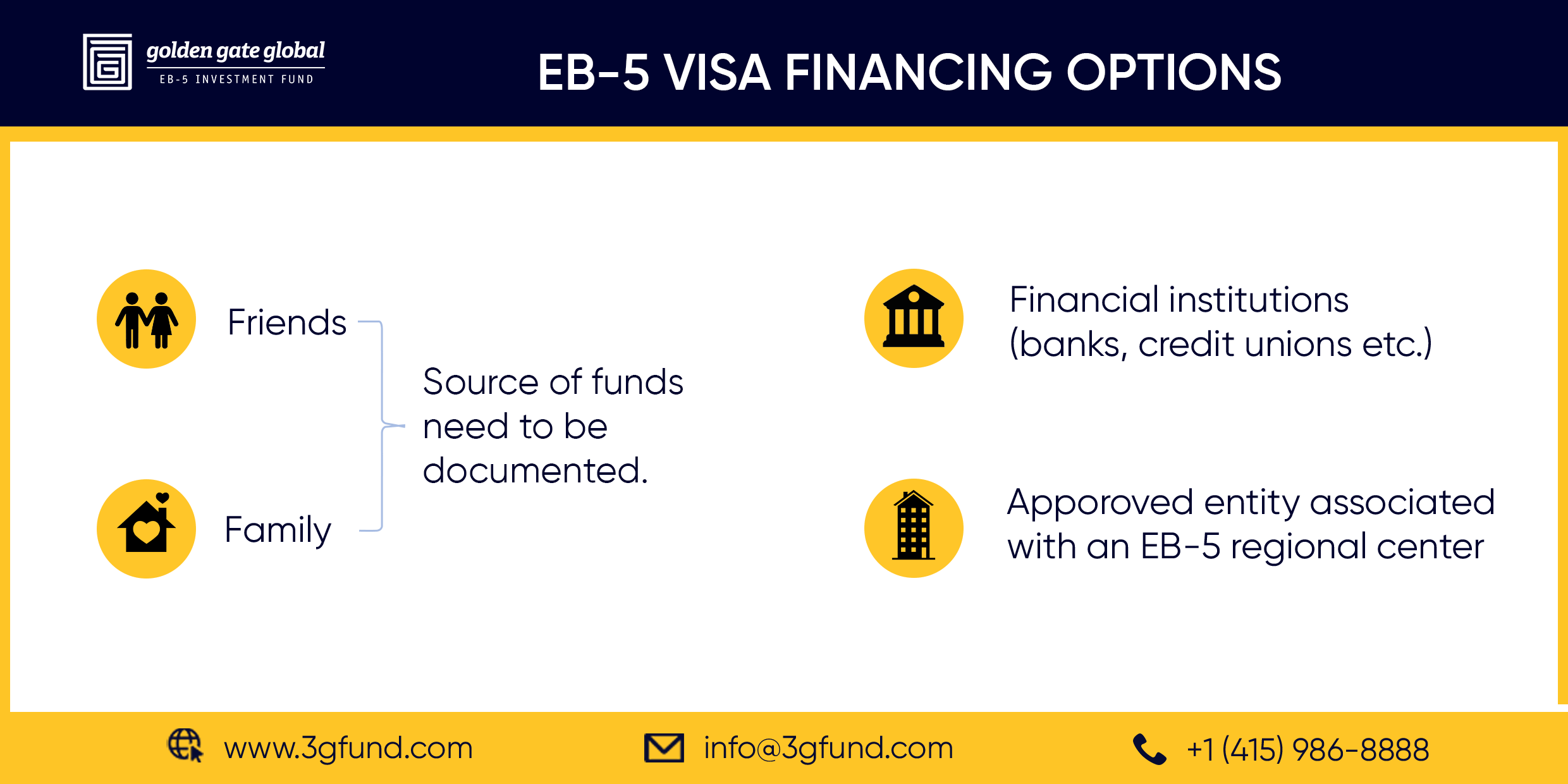

There are various loan sources for EB-5 visas, including friends and family, financial institutions including banks and credit unions, and qualified entities affiliated with regional centers. Each option presents its own advantages, such as easing liquidity constraints, avoiding capital gains taxes and overcoming foreign exchange remittance restrictions. In this article, we explore the different ways investors can utilize financing for EB-5 investments and highlight the benefits and requirements of each approach.

Can I take a loan for making an EB-5 investment?

Yes, an EB-5 investor can use a loan to fund their investment.

Are there loans available for making an EB-5 Investment?

Yes, loans are available for making an EB-5 investment. Various sources, including friends, family, financial institutions, and entities affiliated with regional centers, can provide such loans.

Eligible EB-5 Loan Providers

- Friends & Family: EB-5 investors can secure loans from personal contacts, provided that the lender can fully document the origin of their funds for USCIS compliance. Loans from friends and family can be either secured or unsecured, but thorough documentation of how the lender acquired the funds is critical.

- Financial Institutions: Banks, credit unions, and other financial organizations offer secured loans, often backed by assets like real estate. Home equity loans or line of credit (HELOC) is a popular option, and credit unions may offer more competitive interest rates than traditional banks.

Personal loans, while possible, tend to be limited in amount (usually up to $50,000) and are subject to stricter eligibility criteria based on credit scores and financial health. Secured loans may limit the loan amount to the value of the asset securing it, requiring proper documentation of the asset acquisition for USCIS.

- Affiliated Entities: Certain entities tied to EB-5 regional centers can provide unsecured loans. These are designed to facilitate investments for those who may not have enough liquid assets or substantial credit history or remittance restrictions from their home countries such as from India, China, Pakistan, Vietnam or Myanmar.

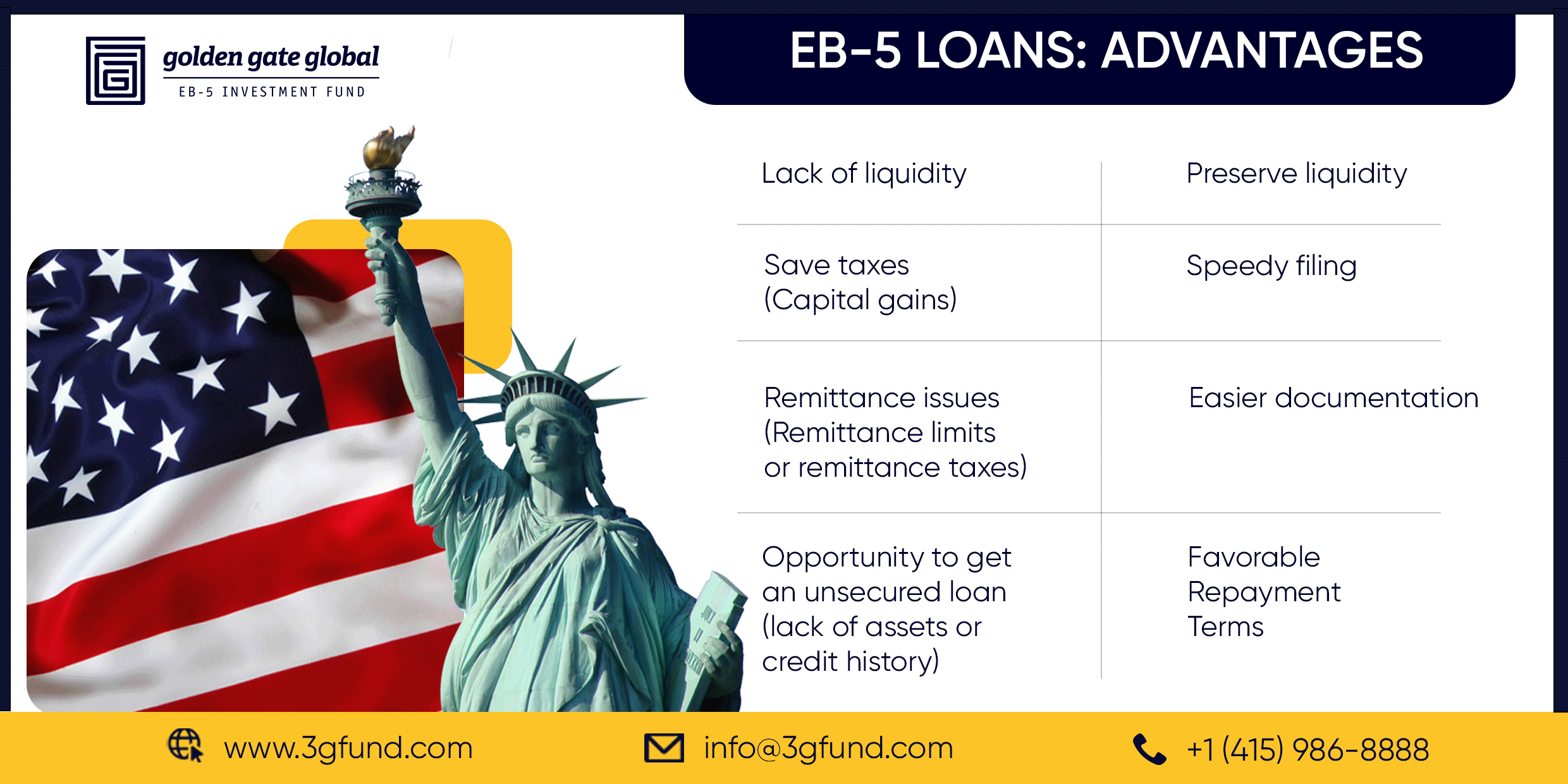

Advantages of Using Financing for EB-5 Investments

Addressing Liquidity Issues: EB-5 investors often have significant assets but lack the full $800,000 needed for the investment. Loans help bridge this gap, enabling investors to meet their EB-5 requirements while maintaining some liquidity. For example, an investor may have $500,000 or $600,000 available but prefer to use a loan to cover the remaining balance.

Preserving Liquidity: Investors might prefer to retain liquidity for other purposes, such as personal investments or emergencies. Even if they can cover the EB-5 investment amount, a loan allows them to preserve their financial flexibility while still participating in the program.

Avoiding Capital Gains Taxes: Some investors opt for loans to avoid triggering capital gains taxes that would occur from selling assets. Depending on the tax implications of liquidating assets, taking out a loan may be a more financially beneficial option. For example, paying off a loan can be cheaper than selling an asset and paying short- or long-term capital gains tax.

USCIS Filing Efficiency: Loans, particularly unsecured loans, offer simpler and faster documentation for USCIS. The process is often as simple as getting loan approval, transferring funds, and submitting the EB-5 application. Secured loans, while more involved due to asset verification, are still manageable with proper documentation.

Remittance Limitations: In countries with strict remittance rules (such as China, India, Vietnam, Bangladesh, and Pakistan), investors often find it difficult to transfer large sums of money abroad. Taking a loan from a U.S.-based institutions can overcome these restrictions, allowing the investor to meet EB-5 requirements without complex international financial planning.

Tax on Remittance: Certain countries, such as India, impose taxes on outgoing remittances. India's Tax Collected at Source (TCS) stands at 20% of the remittance amount. For some investors, it is more advantageous to secure a loan within the U.S. than to remit funds and incur significant tax penalties.

Additional Considerations

Secured vs. Unsecured Loans: Secured loans require detailed documentation of the asset securing the loan, which can complicate the process. Unsecured loans, however, are easier to document and quicker to process, making them a popular choice for EB-5 investors.

Regional Center – Affiliated EB-5 Loan Providers

Loans from entities tied to regional centers offer unique benefits, such as unsecured loans up to $300,000. These loans cater to investors who lack significant assets or credit history. Additionally, they often come with favorable repayment terms, such as a two- or three-year term for principal repayment, where only interest payments are required. This flexibility is especially attractive to investors waiting for other sources of income to become available, such as bonuses or vesting shares, allowing them to delay full repayment.

Investors should take advise from U.S. immigration attorneys, U.S. and local tax and accounting professionals prior to opting for a loan to make their EB-5 investment.

For a Free Consultation with an Experienced EB-5 Professional Enter your Details

Disclaimer

The opinions expressed in this video/blog post are solely those of the presenter/author. The information provided herein is for general informational purposes only and should not be considered as professional or legal advice. The presenter/author or Golden Gate Global do not endorse or take responsibility for any actions taken based on the information presented herein. Viewers/readers are advised to seek appropriate professional advice before making any decisions or taking any actions based on the content of this video/blog post.