E-2 Visa vs. EB-5 Visa: A Comprehensive Comparison for U.S. Immigration Seekers

Immigrating to the United States has long been a dream for individuals and families seeking new opportunities, a fresh start, or access to world-class education and business prospects. The journey to U.S. immigration encompasses various visa programs, each designed to cater to specific needs and circumstances.

This article delves into U.S. immigration through visa programs, covering the EB-5 program and a Treaty Investor Visa E-2. We will draw comparisons between these two options.

Choosing between the E-2 and EB-5 visas is a pivotal decision that can profoundly impact an individual’s immigration journey. It determines whether one opts for a non-immigrant visa with business opportunities or the EB-5 pathway, offering a route to U.S. permanent residency (commonly referred to as a green card) and all the privileges and opportunities that come with it.

Understanding the E-2 Visa

The E-2 visa program, also known as the Treaty Investor Visa, is a non-immigrant visa program that requires foreign nationals from countries that have a qualifying treaty with the United States to invest a substantial amount of capital in a U.S. business. The primary purpose of the E-2 visa program is to promote trade and commerce between the United States and treaty countries by encouraging foreign entrepreneurs to invest in and actively manage businesses in the United States. This visa allows individuals to develop and operate businesses that contribute to the U.S. economy while providing the visa holders and their families the opportunity to live and work in the United States for an extended period, subject to the continued operation of their qualifying businesses.

Eligibility Criteria for E-2 Visa Applicants

Eligibility for the E-2 visa program involves specific criteria that applicants must meet to qualify for this treaty investor visa. Below are the key requirements:

Nationality of Treaty Country: To be eligible for the E-2 visa, applicants must be nationals of a country that has a qualifying treaty of commerce and navigation with the United States. Not all countries have E-2 treaty agreements with the United States, like India.

It is important to note that the list of eligible countries may evolve over time. We recommend visiting the official U.S. government website or consulting with the appropriate authorities to verify your eligibility and confirm whether your country qualifies for the E-2 visa program. You can find the most up-to-date information by following this link.

Substantial “At Risk” Investment: Applicants must make a substantial investment in a U.S. business. While there is no fixed minimum investment amount, it should be sufficient to ensure the success and viability of the enterprise. The investment amount should also be consistent with the type and scale of the business. Typically, investments under $100,000 will be scrutinized more closely.

The investment must be “at risk”, meaning that the funds are irrevocably committed to the business venture and subject to potential gain or loss. Passive investments, such as purchasing real estate for personal use, generally do not qualify for the E-2 visa.

Active Role: E-2 visa applicants must demonstrate that they will play an active and central role in the management and operation of the U.S. business. This typically involves being involved in day-to-day decision-making and having significant control over the enterprise.

Source of Funds: Applicants must prove that the investment funds come from a legitimate and legal source such as savings, business earnings, or loans. Detailed documentation and evidence of the source of funds are usually required to establish the legality and origin of the investment capital.

Business Must be Real and Operating: The U.S. business in which the investment is made must be a real and operating enterprise, not merely a speculative or passive investment. Passive investments, like stock portfolios or real estate, do not meet this requirement. A business should generate income and create job opportunities for U.S. workers.

Job Creation or Maintenance: One of the primary objectives of the E-2 visa program is to promote job creation or preservation. E-2 investors are expected to create jobs for U.S. workers or, in some cases, maintain existing jobs. The number of jobs required can vary depending on the nature and scale of the business.

Intent to Depart: E-2 visa holders are required to maintain the intent to depart the United States when their E-2 status ends, whether by choice or circumstance. This is typically demonstrated through the intent to depart upon the expiration of the visa or termination of the business. E-2 visa holders are typically granted an initial stay of two years, which can be extended indefinitely as long as they maintain the qualifying investment and continue to meet the program’s requirements.

Benefits of the E-2 Visa for Immigrants

One of the key advantages of an E-2 visa lies in its flexibility. Unlike other visa programs, the E-2 visa allows for a broad spectrum of investment opportunities, from launching a startup to acquiring an existing business. This latitude allows individuals with varying business goals and financial resources to find a pathway to the United States under the E-2 visa program.

Ease of access is another noteworthy benefit of the E-2 visa. The application process is often considered more straightforward and quicker compared to other business visa categories such a L1 Visa, making it a compelling option for individuals seeking a relatively expedited path to living and working in the United States.

Furthermore, the E-2 visa permits holders to bring their spouse and their unmarried children under the age of 21 as dependents and authorizes these family members to work or study in the United States. This family-friendly aspect enhances the appeal of the E-2 visa, as it allows families to embark on their American journey together, ensuring a smoother transition and integration into the U.S.

Disadvantages of the E-2 Visa

No Direct Path to Green Card or U.S. Citizenship: One of the core disadvantages of the E-2 visa is its lack of a direct route to a green card or U.S. citizenship. While the visa can be an initial stepping stone toward living and working in the United States, those seeking to become U.S. citizens will typically need to explore alternative immigration pathways. This could involve pursuing a green card through employment, family sponsorship, or other means.

Limited Nationality Requirement: The E-2 Visa, while offering a promising pathway to U.S. business ownership, is bound by a significant limitation—it is available only to nationals of countries that have entered into a qualifying treaty with the United States. The citizens of countries without such treaties do not have access to this visa category. This nationality requirement significantly narrows the pool of potential applicants, leaving many aspiring entrepreneurs ineligible to pursue their American dreams through the E-2 visa program.

Temporary Status: Another notable drawback of the E-2 visa is its inherently temporary nature. Unlike some other visa categories that pave the way to permanent residency or even citizenship, the E-2 visa offers only temporary residency in the United States. Visa holders must continuously maintain their qualifying investment, and they may need to go through the renewal process periodically to retain their visa status. This temporal limitation can be a source of uncertainty and may necessitate future immigration planning beyond the E-2 visa.

Investment Risk: The E-2 visa requires applicants to make a substantial and “at risk” investment in a U.S. business. While this investment can be a strategic move, it comes with inherent risks. If the business faces financial challenges or does not succeed as anticipated, the investor may incur losses. Moreover, a business setback could jeopardize the investor’s visa status, creating a complex interplay between business management and immigration compliance.

Dependency on the Business: E-2 visa holders’ continued stay in the United States is closely tied to the success and maintenance of their business because they do not have the freedom to work for an alternate U.S. company. Any significant business disruption or closure could impact the investor’s visa status and legal presence in the country. Dependence on the business’s fortunes underscores the importance of thorough business planning and risk management for E-2 entrepreneurs.

Exploring the EB-5 Visa

The EB-5 visa, also known as the EB-5 Immigrant Investor program or the EB-5 program, is designed to attract foreign investors willing to invest significant capital, thereby stimulating job creation and economic growth. Under this program, eligible investors and their immediate families have the opportunity to obtain lawful permanent residency (commonly referred to as a green card), which grants them the right to live, work, and study anywhere in the United States.

One notable benefit of the EB-5 program is that immediate family members, including the investor’s spouse and unmarried children under the age of 21, are eligible to apply for derivative green cards. Upon entering the United States, these family members can also obtain work permits (Employment Authorization Documents, or EADs). This allows them to seek employment or engage in business activities in the United States, providing additional opportunities for family members to establish themselves and contribute to American society during the conditional residency period.

To qualify for the EB-5 visa, investors are typically required to invest either $1.05 million in a non-targeted employment area (non-TEA) or $800,000 in a TEA, which is an area with high unemployment or rural designation. In addition to the capital investment, they must also demonstrate the creation of at least 10 full-time jobs for qualifying U.S. workers within 2 years of their investment. To learn more details about EB-5 visa, please read this article.

The EB-5 visa process typically involves several stages, and the duration can vary based on individual circumstances. Usually, investment is locked for 3-5 years. After making the qualifying investment and filing the initial petition (Form I-526E), investors and their immediate family members can expect to wait for adjudication, which can take around 18 to 24 months or longer, depending on factors like visa backlog and processing times. Once the I-526E petition is approved, investors may proceed with either adjusting their status to conditional permanent residents if they are already in the United States or consular processing if they are abroad. After successfully obtaining conditional green cards, they are required to maintain their investment and meet job creation requirements for two years. To learn more details about the EB-5 process and timelines, please read this article.

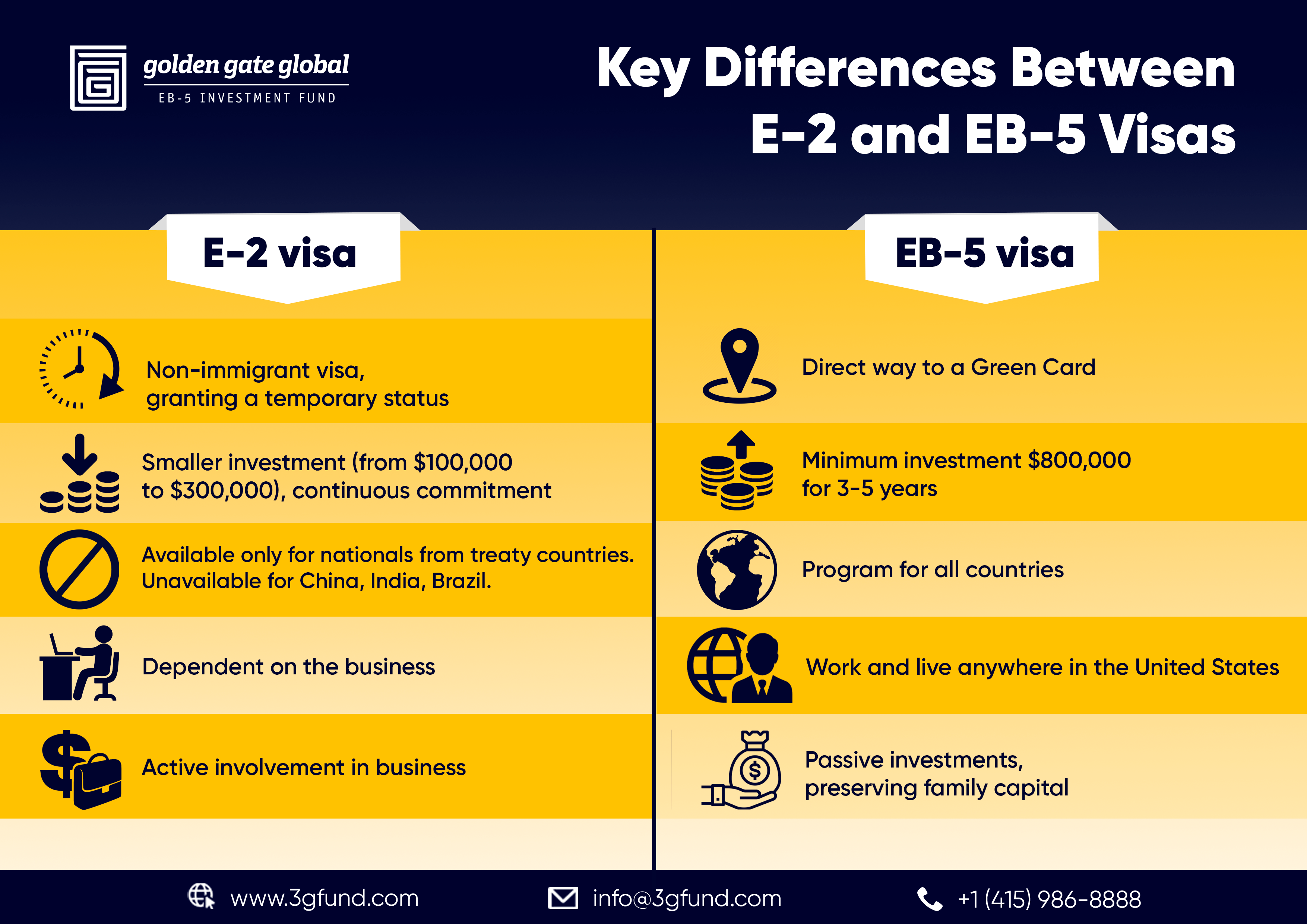

Key Differences Between E-2 and EB-5 Visas

The EB-5 visa is a direct way to a green card, granting a permanent status. The E-2 is a non-immigrant visa, granting a temporary status.

The E-2 visa, a non-immigrant visa, is fundamentally temporary, catering primarily to investors who intend to oversee their operations in the United States without necessarily migrating permanently. It requires a substantial investment, but significantly less than the EB-5, and must be renewed periodically. The E-2 visa holder must demonstrate an intent to leave the United States upon the visa’s expiration or termination. Conversely, the EB-5 visa falls under the immigrant visa category, offering a direct path to permanent residency in the United States. This fundamental distinction between the temporary, business-focused nature of the E-2 visa and the permanent, investment-driven pathway of the EB-5 highlights the diverse strategies and outcomes inherent in U.S. immigration policy for foreign investors.

The E-2 visa is a faster path to entry into the United States but does not lead to a green card.

The E-2 visa process is generally faster and less complex. Once the investment is made and the business is operational or about to operate, the applicant can expect a decision within a few months. The E-2 visa is typically granted for 3-5 years, depending on the country of origin, and can be renewed indefinitely as long as the business continues to operate successfully.

In contrast, the EB-5 visa process is more time-consuming and complex, largely due to its path to U.S. permanent residency. After making the requisite investment and filing the petition (Form I-526E), the processing time can vary widely, often taking several years. Once approved, the investor and their immediate family members can apply for conditional permanent residency, which is granted for 2 years. During this period, they must prove that the investment has met the required job-creation criteria. Afterward, they can apply to remove the conditions (Form I-829), leading to permanent residency. This step itself can take additional years. To learn more details about the EB-5 process and timelines, please read this article.

Thus, while the E-2 visa offers a quicker route to enter and operate a business in the United States, the EB-5 provides a longer, more complex pathway to permanent residency and, eventually, a green card.

EB-5 requires a minimum $800,000 investment for 3-5 years. E-2 visa requires a smaller investment amount but a continuous commitment.

A pivotal distinction between the E-2 and EB-5 visas lies in their respective investment requirements, reflecting differing objectives and benefits. The E-2 visa, designed for entrepreneurs from countries with which the United States maintains a treaty of commerce, demands a “substantial investment.” While there is no minimum amount set by law, the typical range is between $100,000 to $300,000. This investment must be sufficient to establish a viable and successful business.

By contrast, the EB-5 visa, targeting immigrant investors seeking permanent residency, requires a significantly larger investment. The minimum investment is $1.05 million for non-TEA, or $800,000 in a targeted employment area (TEA), usually a rural or high-unemployment area. This stark difference in investment thresholds underscores the E-2’s focus on operational business involvement and the EB-5’s pathway to residency through substantial economic contribution.

The EB-5 Program is suitable for people from all countries.

The EB-5 program offers a broadly inclusive path to U.S. immigration, making it suitable for individuals from virtually all countries. Universal eligibility is a significant advantage of the EB-5 program, as it provides an equal opportunity for investors from diverse backgrounds to pursue their American dreams. In contrast, the E-2 visa is not accessible to nationals of specific countries due to the absence of qualifying treaties.

EB-5 investors are free to work anywhere and live in the United States. EB-5 investment could be a passive one, preserving family capital.

One of the key differentiators between the EB-5 and E-2 visa programs lies in the degree of involvement in business management and the resulting freedom to live and work in the United States. EB-5 investors enjoy the flexibility to work and reside anywhere in the U.S., independent of the day-to-day operations of their investment project. This allows them to pursue diverse employment opportunities, start new businesses, or engage in various activities nationwide. In contrast, E-2 visa holders are required to maintain active involvement in the management and operation of the U.S. business their investment supports. Their visa status is closely tied to their role in business management, making it necessary for them to oversee the daily affairs of the enterprise. This difference between business engagement and personal freedom plays a significant role in choosing between the EB-5 and E-2 visa programs to fulfill investors’ aspirations in the United States.

For a Free Consultation with an Experienced EB-5 Professional Enter your Details

Disclaimer

The opinions expressed in this video/blog post are solely those of the presenter/author. The information provided herein is for general informational purposes only and should not be considered as professional or legal advice. The presenter/author or Golden Gate Global do not endorse or take responsibility for any actions taken based on the information presented herein. Viewers/readers are advised to seek appropriate professional advice before making any decisions or taking any actions based on the content of this video/blog post.