Documenting Source of Funds for EB-5 Petition for Indian EB-5 Investors

To qualify for the EB-5 visa, EB5 applicants must provide comprehensive information about the sources of funds to convince USCIS of the legality of investment money. These sources can include the proceeds from property sales, loans (secured and unsecured), and professional or business income. In this article, we will discuss the correct way to provide this information and avoid common mistakes, as well as the potential money transfer issues that Indian investors may face and helpful considerations about it.

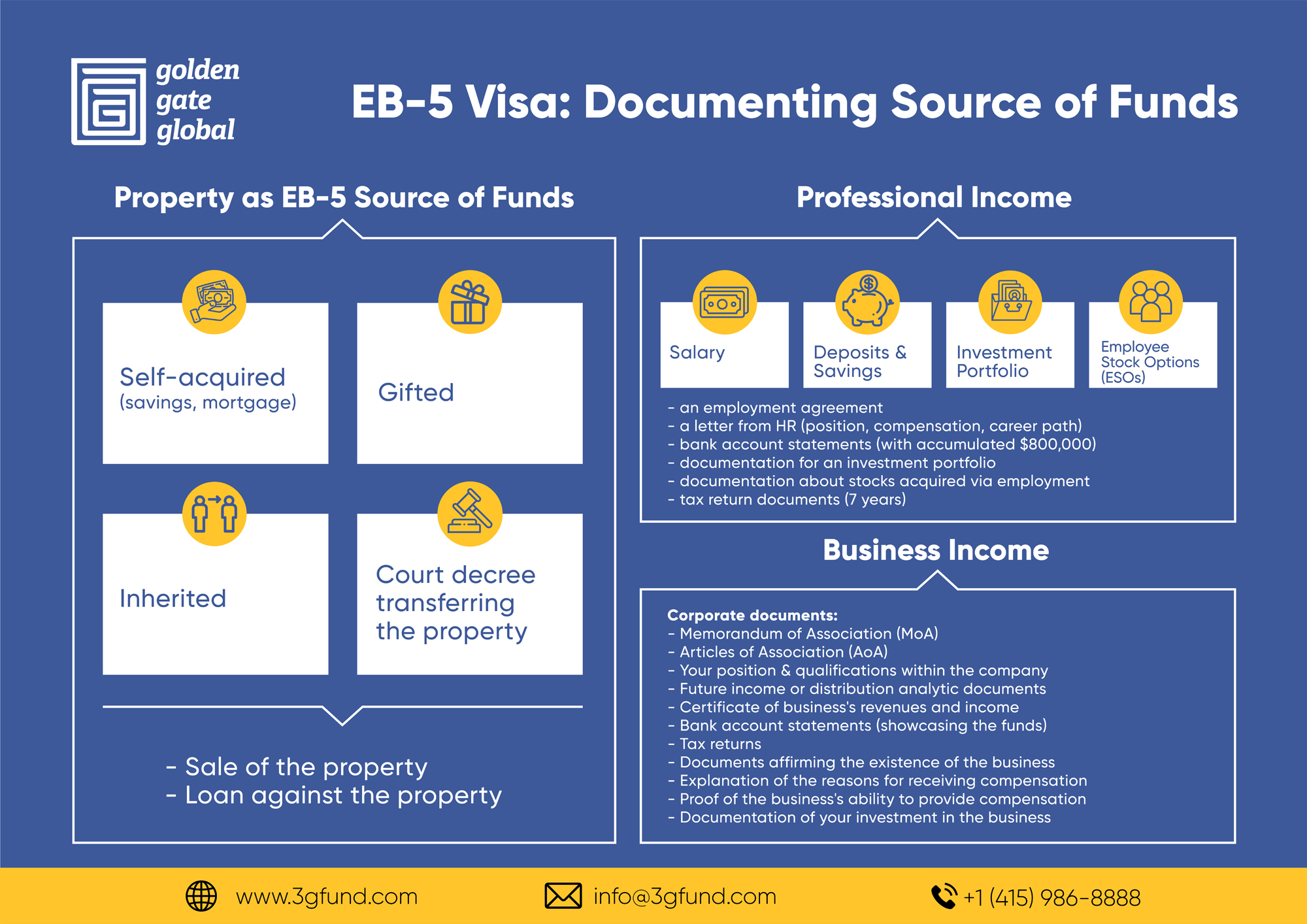

Property as EB-5 Source of Funds

One of the most common sources of funds for Indian investors is the sale of property. It could be acquired in different ways:

- Self-acquired property (savings, mortgage)

- Gifted property

- Inherited property

- Court decree transferring the property

Simply showing the sale agreement and sale proceeds to USCIS is not enough. They want to make sure that the property was acquired through legal means. The documentation process here will depend on how exactly the property was acquired.

It is crucial to demonstrate how you acquired the property and to provide supporting documentation. It is essential to show that you had been able to pay down payments and mortgage or explain the accumulation of cash if the property was bought with cash.

Documentation of Inherited Property

For investors who have inherited property from their parents or relatives, it is necessary to demonstrate a relationship with them. You must provide the inheritance documents, including the will, probate, and any court orders, if applicable. In some cases, if property has been acquired by an ancestor recently (± last 1-3 years), additional documents about the original source of funds could be required too.

Gifted Properties

In the case of gifted properties, it is important to have a registered gift deed as required by Indian real estate laws. You must demonstrate how the person who gifted you the property acquired it. USCIS wants to make sure that the source of funds used to acquire the property is legitimate and clean.

Court-Awarded Property

In situations where there are disputes and a court has awarded a property to a litigant, it is crucial to track the history of the property and present the court order. The documentation should also explain how the property was acquired.

Hindu Undivided Family (HUF) Property

If the property falls under the construct of Hindu Undivided Family property, you have to explain to USCIS how the investor acquired the property or part of this and how they sold their half and received the funds.

Document Factors of Property Appreciation

It is not necessary, but it is advisable to document the factors contributing to the appreciation of the property. For example, property in Bangalore became more expensive because of the new ring road. In Mumbai, all financial institutions moved from Nariman Point to Bandra Kurla Complex, and property around it is booming.

Providing evidence of the property's growth and value appreciation over time, especially in specific areas or neighborhoods, can strengthen your case. Comparative property prices from local websites can also be useful in demonstrating the reasonable value of the property.

Sale Documentation

You must provide sale documentation, including receipts and proof of documented payments such as bank transactions or cash receipts. You can only use the documented funds for your EB-5 application. Once you have the receipt of funds in your account, you can proceed with transferring them. If you are filing a regional center EB-5 petition, you will transfer the funds to an escrow account.

Loans Against Property. Common Mistakes for Indian Investors.

You have the option to obtain funds by using loans against property in India or in the US. This is a crucial issue, and many immigration attorneys make mistakes in this area. If you are in the United States, and you take a home equity line of credit (HELOC), you need to provide all the acquisition documents we discussed before, and you receive a home equity line of credit against the equity in your house. If you transfer that to the escrow account, it is perfect.

Problems arise when attorneys advise investors to take a loan against their properties in India. Taking a loan against properties in India is possible, but you must make sure that the loan sanction letter is unrestricted. Usually, the loan sanction letter will specify a particular purpose for the loan. For the EB-5 visa, the loan must be unrestricted, meaning there should be no specific purpose assigned to it. The loan sanction letter should reflect this.

Prohibition of Transferring Bank Loans Abroad in India

Transfer of bank loans abroad is not allowed under Indian remittance laws. It is essential to structure these loans properly. Your local bank manager, who is focused on meeting their goals, might offer you the loan. Issues arise when this transaction goes to a branch in Bombay, for example, that handles all the foreign remittances. They can cancel that transaction, and you are stuck with a loan on which you must pay interest, and it becomes useless to you since it can’t leave India. It is crucial to work with professionals in India who understand how to structure these loans or find alternative methods of remitting funds out of India.

Professional Income as a Source of Funds

Professional income could be earned in the United States, India, or any other country. In almost all cases, for applicants from different countries, the required documents are similar. You should provide employment documents, which include the following:

- a resume

- an employment agreement

- a letter from HR discussing your current position, compensation, and maybe your career path in the company

- bank account statements that show how you accumulated $800,000

- documentation for an investment portfolio

- documentation about stocks acquired via employment

- tax return documents (recommended for 7 years).

Bank account documentation involves showing the regular deposits of your professional income into your bank account. If you invested money, you also need to provide documentation about it. In India, there is a concept of Fixed Deposits (FD), which is equivalent to Certificates of Deposit (CD) in the United States. You should show your fixed deposits and systematic investment portfolio, providing statements that demonstrate the growth of your portfolio or mutual funds. Then, you liquidate these investments and transfer the funds to your account.

You need to provide bank account statements that show the receipt of these funds and subsequent transfer to an escrow account in the United States for filing your EB-5 petition.

In some cases, such as for bankers in India, there might be additional documentation required for Employee Stock Options (ESOs). There is internal documentation within an institution where they explain how ESO can be used and liquidated and how you get your money.

All of this is the way to avoid receiving a request for evidence from USCIS and just getting straight approval with your source of funds.

Business Income as a Source of Funds

If there is business income, you need to document not only your personal qualifications and position but also the existence of the business. This requires providing corporate documents such as:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Demonstrating your position and qualifications within the company

- Future income or distribution analytic documents

- Certificate of business's revenues and income from HR or CFO

- Bank account statements showcasing the receipt of these funds and their remittance to the United States

- Tax returns

- Documents affirming the existence of the business

- Explanation of the reasons for receiving compensation

- Proof of the business's ability to provide compensation

- Documentation of your investment in the business

Remittance Considerations for Indian Investors

You need to consider the Foreign Exchange Management Act (FEMA) and RBI guidelines, which are subject to change. In 2013 – 2014, the remittance limit for Indians was only $75,000. relatives were required, around seven or eight, to file one petition. The investment amount was $500,000 at that time.

Today the remittance limit for Indian residents stands at $250,000, while for non-resident Indians, it is $1,000,000, but RBI guidelines do not allow combining these limits.

If the primary applicant is in the United States on an F-1 visa, H-1B visa, or similar type of visa, and the funds are coming from India, receiving the funds as a gift or maintenance money is allowed. Your parents, grandparents, and siblings can all remit up to $250,000 each if they have a permanent account number or PAN. When receiving gifts or loans from friends or family, or even unsecured loans, they need to document the source of funds. If you receive a loan from a sibling, you must provide documents that prove the legitimacy of your sibling's funds. There is no way to avoid documenting the source of funds as it is of utmost importance. USCIS doesn’t want illegal money entering the United States.

For a Free Consultation with an Experienced EB-5 Professional Enter your Details

Disclaimer

The opinions expressed in this video/blog post are solely those of the presenter/author. The information provided herein is for general informational purposes only and should not be considered as professional or legal advice. The presenter/author or Golden Gate Global do not endorse or take responsibility for any actions taken based on the information presented herein. Viewers/readers are advised to seek appropriate professional advice before making any decisions or taking any actions based on the content of this video/blog post.