Regional Center Due Diligence for EB-5 Investors

A Regional Center is an entity authorized by USCIS to sponsor EB-5 projects. Regional Centers act as fund managers for EB-5 investors. They assist EB-5 Investors in making a qualifying EB5 investment to gain U.S. Permanent Residence or Green Card.

What does a Regional Center do?

EB-5 Project Due Diligence

An EB-5 Regional center scouts EB5 projects for investments and performs due diligence to make sure that the project meets all USCIS requirements for EB-5 visa and is a sound financial investment. Regional centers retain required professionals to perform due diligence: immigration, corporate and securities attorneys, economists, real estate finance experts, etc.

When a Regional Center performs Due Diligence, they look at multiple factors:

- Location: Whether the project is in a Targeted Employment Area (rural or a higher employment area) so that it qualifies for the minimum investment amount of $800K.

- EB5 Job Creation: Regional Centers work with economists to ascertain the number of qualifying direct and indirect jobs that will be created by the EB5 project upon completion.

- Strength of the Developer: Regional Centers examine the core competence of the developer of the project and the experience in the particular asset class.

- Market Analysis & Financial Projections: Regional Centers conduct a market study of the demand metrics of the project to ascertain the financial viability and safety of EB5 funds.

A regional Center typically spends from 3 months to a 1 year conducting thorough research on a project before presenting it to USCIS.

File documents with USCIS

After completing financial due diligence, Regional Centers retain immigration and securities attorneys to draft a business plan and offering documents to be filed with USCIS.

Raise & Deploy capital for the project

After filing the business plan and related documents with USCIS, EB5 Regional Centers raise capital for the project from EB-5 investors, typically $800K for TEA or $1.05M if the project is not located in a TEA. Once the capital has been raised, a Regional Center deploys this capital into the project.

Advocate for Investors: Track Project Spendings, Provide Investors Updates

Regional Centers represent the investors rather than the borrowers. EB5 Regional Centers are responsible for project oversight and making sure funds are deployed in accordance with the business plan submitted to USCIS and the project creates sufficient qualifying EB5 jobs for all the investors.

Regional Centers keep investors informed about the project's status, the borrower's performance, how the funds are being used, and the number of jobs created. They may provide photos to showcase the project's progress to the investors.

Disburse Annual Interest

The main return on investment from the project is a EB-5 visa and repayment of principal investment to EB5 investors. There is also minimal annual interest earned on the investment. For a debt model, it can be around 1% per annum, while a preferred equity model may offer around 2% to 3% interest. The Regional Centers are responsible for disbursing the annual interest to the investors.

Ensure the Borrower Repays on Time

A typical loan term for an EB5 investment in case of a debt model is minimum 5 years, and maximum 7 years. Regional Centers are tasked with making sure that they take all necessary steps to preserve the capital of the investors and take appropriate action in case of default in repayment of loan by the borrower. Regional Center can initiate a class action lawsuit on behalf of all investors, the likelihood of a favorable outcome is higher compared to individual investors suing a borrower. Additionally, the cost of litigation is shared among multiple investors. It would make it more manageable for each person.In our opinion, EB-5 investments are better protected with a Regional Center.

Funds Redeployment

Regional Centers have the responsibility to redeploy the funds. Redeployment happens when the borrower repays the funds, but you as an EB-5 investor have not yet qualified for repayment.

EB5 loan agreements are structured to return the capital only after an EB5 investor has spent 2 years as a conditional green card holder. If the investor has not completed 2 years, the funds need to be reinvested. Regional Centers are responsible for reinvesting the capital. That is why it makes it even more important to invest in a trustworthy Regional Center because they have the power to control your funds once the borrower repays.

How are EB-5 Investments Structured?

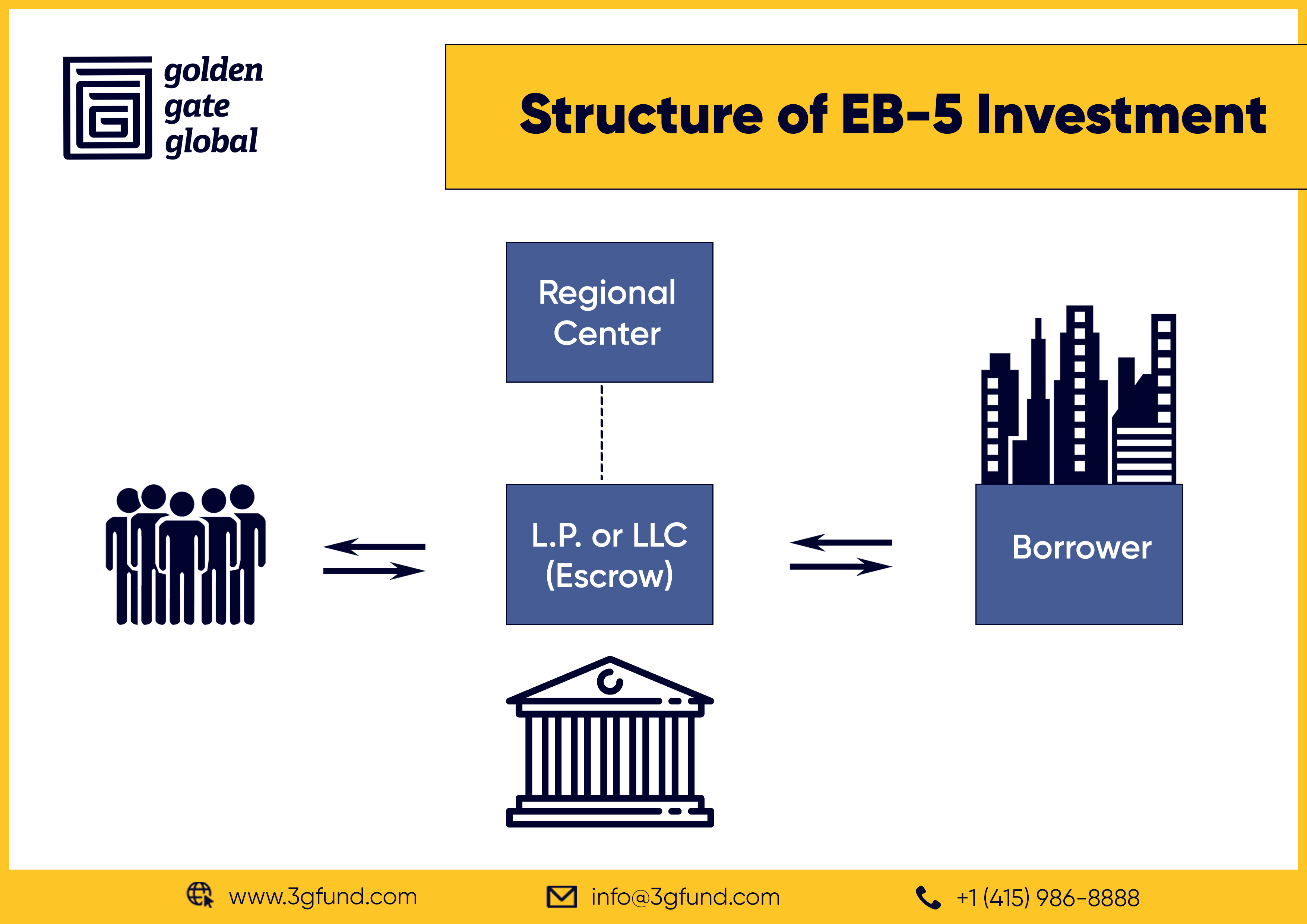

Regional Centers are mostly independent entities. They are usually a lending institution or a financing institution for a project.

EB-5 investors transfer their funds into an escrow account which belongs to a New Commercial Enterprise (NCE). This is usually in the form of a limited partnership (LP) or a Limited Liability Company (LLC). Investor’s funds end up going to an escrow account. Regional Center executives don't have access to these funds. They are usually held by a major bank.

From the escrow account the money can either go to the borrower or go back to the investors. So, in the case of a debt model, the money goes in as a construction loan and the borrower uses this money to construct the asset.

Once the asset is complete and stabilizes, usually the borrower refinances this loan, repays it to the escrow account. Then it goes back to the EB-5 investors.

In case of preferred equity, there is no such loan term per se. However, the developer works on similar timelines for repayment of EB5 funds. The funds go to the escrow account. Then it goes back to the investors.

The critical factor between the difference between a preferred equity model and a debt model is that in a preferred equity case you are junior to all creditors. Whereas in a debt model you can know your position. If you're a mezzanine lender, that means you're junior to the bank loan and senior to all the equity and preferred equity holders in the project.

Things to keep in mind when investing

- Regional Centers are the representatives for the investors. So the borrower or person who’s attracted your preferred equity needs to come through on the repayment. In case of default, the Regional Center can take legal action on behalf of all the investors.

- Another important point to note is that repayment often occurs through asset refinancing. This sets a lower bar for repayment compared to relying on asset sales. When repayment depends on asset sales, investors are more exposed to the macroeconomic factors.

Performing Regional Center Due Diligence

Before making a decision to go with a specific regional center, investors should make sure that the EB5 Regional Center is a reliable partner in the EB-5 Visa journey. Conduct their own due diligence on the EB5 Regional Center. Investors can seek help from attorneys and real estate experts for this. But there are some common sense questions investors can ask the Regional Center.

Knowing the Location

When investing with a Regional Center, it is important to personally meet their employees, visit their office, and observe business operations. Just like an investor would visit a bank or wealth manager to check their physical location. This step allows EB5 investors to determine the scale of the operation and if the firm manages projects in a location they are familiar with or if they solely rely on external experts.

Check the years of experience

It’s recommended to invest in a Regional Center with minimum 8 to 10 years experience. This duration allows the Regional Center to have experienced all stages of the EB-5 application process, including attracting investments, obtaining conditional green cards for investors, securing unconditional green cards, repayment and potentially redeployment of funds. Since this is a combination of investment and immigration, evaluating the Regional Center's performance is essential for making a decision.

Questions to Ask Regional Center

- the amount of EB-5 funds raised,

- the number of EB-5 projects that have been sponsored by the Regional Center,

- the number of green cards have been approved,

- number of unconditional green cards that have been approved,

- the number of EB-5 investors that have been repaid.

The above mentioned questions will give an idea about the experience of a Regional Center. And of course, if it's a new Regional Center, they will not have a track record. It doesn't mean they are bad, we just don't know if they're good or bad.

Ask about negative experience

Do not hesitate to ask not only the positive aspects of a Regional Center performance, but also the negative ones.

Are there any projects that received a project denial from USCIS?

After all the hard work investors have done in putting together $800K, ensuring attorneys prepared the right documentation, there are still factors beyond an investors control. Such as, proper submission of the project documents and the viability of its business plan. It is therefore important to inquire about any previous project denials that may have had a negative impact on investors.

Are there projects that failed to create necessary qualifying jobs for all the investors?

The most unfortunate outcome in EB5 is investing capital, obtaining approval of a conditional green card, and eventually receiving a denial for the unconditional green card. This sudden twist can disrupt a 7 to 8-year journey, leaving investors scrambling for an alternative non-immigrant visa or potentially having to leave the US. After investing so much time and effort, this unexpected scenario can be really challenging.

Number of projects in which investors didn't receive part or whole of their invested EB-5 funds upon the expiration of the loan term?

A green card is a desired goal, but it is equally important to ensure that the $800,000 investment is not simply a donation. Therefore,investors should not hesitate to ask if there are any projects that defaulted in the past? Did the Regional Center sue the developer? What was the result of that litigation? Or what were the actions that were taken?

Are there any projects that have been terminated prior to completion?

Another important question to ask is how many investors have lost their capital. This will help determine if the Regional Center is currently or potentially involved in litigation. If a Regional Center has raised $100M from over 100 investors, there is a possibility of lawsuits if any wrongdoing is discovered. Additionally, it is important to find out if any projects were terminated before completion. This aspect directly impacts job creation and the return of EB5 investment. Project termination could occur due to insufficient job creation or issues (for example, cost overruns or litigation delays). It's also essential to investigate if the project stalled because the developer ran out of funds.

Has the Regional Center or its affiliates ever been reprimanded by Securities & Exchange Commission (SEC) or entered into a settlement with the SEC?

The EB-5 industry is regulated by both USCIS and the Securities Commission. Hence, another way to figure out whether a Regional Center is worth your investment is whether in the past they've broken any laws, whether they have failed to meet the requirements of immigration law, or they've not complied with securities laws, have there been any sanctions, fines, settlements?

EB5 Investors should perform Regional Center due diligence before investing. Regional Center plays a vital role in managing the funds of the EB5 investors. EB5 Investors should invest with a reliable partner that protects their funds and helps obtain U.S. Green Card.

For a Free Consultation with an Experienced EB-5 Professional Enter your Details

Disclaimer

The opinions expressed in this video/blog post are solely those of the presenter/author. The information provided herein is for general informational purposes only and should not be considered as professional or legal advice. The presenter/author or Golden Gate Global do not endorse or take responsibility for any actions taken based on the information presented herein. Viewers/readers are advised to seek appropriate professional advice before making any decisions or taking any actions based on the content of this video/blog post.